Get the job you really want.

Maximum of 25 job preferences reached.

Top Tax Manager Jobs in Seattle, WA

eCommerce • Retail • Software • Automation

The Senior Tax Manager will manage third party tax providers, oversee tax filings, comply with regulations, and mentor team members.

Top Skills:

Accounting SystemsData Management ToolsTax Software

Beauty

The Corporate Tax Manager will manage income tax provision and compliance, prepare tax-related entries, support tax legislation research, and collaborate with corporate finance.

Top Skills:

MS Office

Blockchain • Cryptocurrency

The Product Tax Lead will manage tax requirements in product lifecycles, ensuring compliance and collaboration between Tax, Product, and Engineering teams.

Top Skills:

AIIndirect Tax SoftwareMachine LearningTax Engines

Artificial Intelligence • Marketing Tech • Mobile • Software

The Tax Manager will handle tax provisions, compliance processes, documentation, and research while collaborating on strategic tax planning and legislative updates.

Top Skills:

Asc 740Federal And State Tax ConceptsTax Software

Cloud • Fintech • Financial Services

Oversee tax compliance and planning for clients, manage a team, mentor staff, provide feedback, and ensure accuracy in tax submissions.

Top Skills:

KarbonLacerteQuickbooks Online

Artificial Intelligence • Blockchain • Fintech • Financial Services • Cryptocurrency • NFT • Web3

Manage global tax provisions, ensure compliance with ASC 740, prepare SEC disclosures, and optimize tax accounting processes at Coinbase.

Top Skills:

Asc 740One Source Tax ProvisionTax ComplianceUs Gaap

Information Technology • Financial Services

Seeking experienced Remote Tax Managers for tax planning, research, and review of tax returns to provide recommendations and savings opportunities.

Top Skills:

CpaEa

Fintech • Software

As an International Tax Manager, you will file tax returns for venture capital clients, collaborate with teams, and simplify US international tax structures.

Top Skills:

Tax Engine SoftwareUs International Tax Filings

Fintech • Software

Manage US and EU indirect tax compliance, prepare tax returns, assist on audits, maintain internal tax positions, and collaborate with teams on tax-related matters.

Top Skills:

AnrokAvalaraFonoaGoogle SuiteExcelS&U Tax Software

Fintech • Payments • Financial Services

The Tax Senior Manager leads collaboration on corporate income tax issues, building client relationships, and mentoring junior staff, requiring 8+ years of experience and a CPA or EA license.

Top Skills:

Corporate Income TaxIncome Tax ProvisionsResearch & Development CreditsStock Options

Blockchain • Consumer Web • Fintech • Software • Cryptocurrency

As a Crypto Tax Analyst, you'll ensure the accuracy of CoinTracker’s tax engine, audit operations, and review tax-related content while leading the US tax efforts.

Top Skills:

Cryptocurrency FundamentalsUs Tax Regulations

Business Intelligence • Consulting

As a Tax Manager, you will lead tax services, manage client relationships, ensure compliance, and oversee tax project outcomes. You will mentor staff and maintain client satisfaction through effective tax planning and consulting.

Top Skills:

Accounting SoftwareC CorporationsCompliance ManagementCorporate TaxationPartnerships TaxationS CorporationsTax Services

New

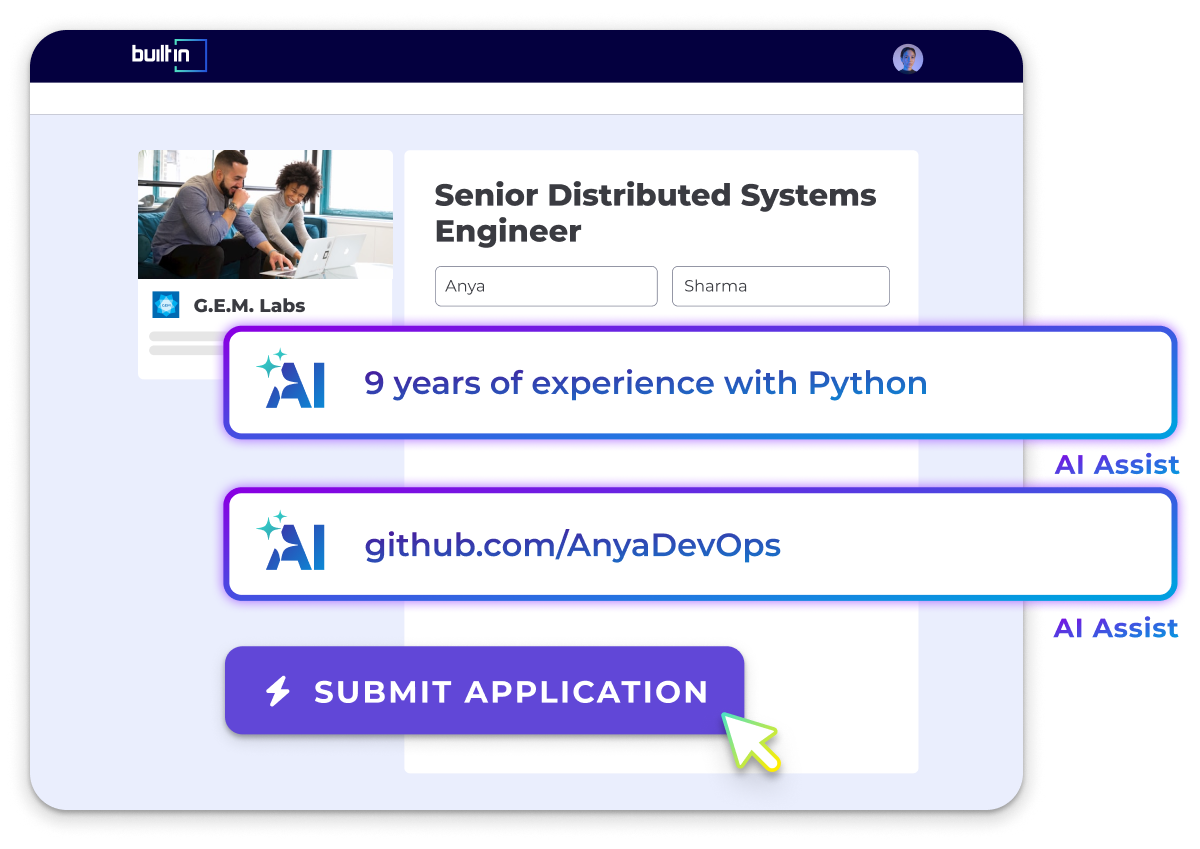

Cut your apply time in half.

Use ourAI Assistantto automatically fill your job applications.

Use For Free

Cloud • Information Technology

The Global Tax Manager oversees global and US tax compliance, manages audits, prepares tax provisions, and liaises with stakeholders and tax authorities.

Top Skills:

AlteryxErp SystemsOnesourceOracleSAPTax Compliance SoftwareWorkday

Financial Services

The Tax Manager I leads client relationships and manages the preparation and review of tax returns for high-net-worth clients, providing timely and accurate tax services and communication.

Top Skills:

SureprepUltratax

Payments • Financial Services

Lead tax compliance and treasury operations, manage teams and external firms, oversee financial analysis, and ensure strategic tax planning.

Top Skills:

AccountingGlobal Cash ManagementTax Compliance

Reposted 51 Minutes AgoSaved

Consulting

Lead and manage complex tax engagements, ensuring accuracy in tax return preparation, while mentoring team members and delivering quality client service.

Top Skills:

Prosystem/EngagementTax Technology

Travel

The Senior Tax Manager will oversee North American tax compliance and planning, support provisions, liaise with advisors, and enhance tax processes.

Top Skills:

AvalaraExcelGoogle BigqueryNetSuiteSequel

Fintech • HR Tech • Payments • Financial Services

The Senior Tax Manager oversees tax compliance and planning across jurisdictions, manages tax filings, and provides strategic tax guidance while collaborating with finance and legal teams.

Top Skills:

ExcelGosystemMS OfficeOnesourceSap Tax

Fintech • Payments • Financial Services

Manage client relationships for tax-exempt 401(k) plans, ensuring compliance and service excellence, while collaborating with various teams.

Top Skills:

401(K) Plan AdministrationForm 5500

Information Technology • Software

The Sr. Manager, Tax Account Management leads a team that manages customer engagements for tax services, ensuring quality delivery through metrics and proactive processes, while enhancing technology solutions and maintaining strong customer relationships.

Top Skills:

ExcelMs Office (WordPowerPointVisio)Workday

Fintech • Software

Lead the development and automation of Carta's Fund Tax platform, transforming complex tax processes into user-friendly software solutions while collaborating closely with engineering and tax teams.

Top Skills:

Api IntegrationsCalculation EnginesData Schemas

Fintech • Consulting

The Manager of International Income Tax oversees a team, providing tax consulting services, building client relationships, and ensuring quality project delivery.

Top Skills:

Microsoft AccessExcelMicrosoft OutlookMicrosoft PowerpointMicrosoft Word

Reposted 15 Days AgoSaved

Fintech • Consulting

Manage Employment Tax projects, ensure compliance, develop client workplans, conduct presentations, and maintain client relationships. Requires strong tax knowledge.

Top Skills:

Microsoft AccessExcelMicrosoft OutlookMicrosoft PowerpointMicrosoft WordSalesforceWorkday

Music • News + Entertainment

The Tax Manager will oversee indirect and withholding tax compliance, prepare tax forms, resolve disputes, and assist with audits.

Top Skills:

Accounting SoftwareTax Compliance Systems

Food

As a Tax Accounting Manager, you will manage tax risk and compliance, oversee tax operations, and ensure accurate reporting while leading tax-related initiatives globally.

Top Skills:

HyperionExcelMicrosoft WordOracle

Top Seattle Companies Hiring Tax Managers

See AllPopular Job Searches

All Filters

Total selected ()

No Results

No Results

.png)

_0.png)